Experienced Leadership. Investment Discipline. Dependable Partner.

We pursue a value-add hands-on strategy focusing on undermanaged and under-funded complicated properties. We seek to create value by active asset management on the basis of an attractive entry price. We consider a range of different properties from mixed use income-producing property types, including multifamily, retail, office and industrial properties to empty hotels, nursing homes and educational facilities across the midlands of the United Kingdom

Experienced Leadership. Investment Discipline. Dependable Partner.

We pursue a value-add hands-on strategy focusing on undermanaged and under-funded complicated properties. We seek to create value by active asset management on the basis of an attractive entry price. We consider a range of different properties from mixed use income-producing property types, including multifamily, retail, office and industrial properties to empty hotels, nursing homes and educational facilities across the midlands of the United Kingdom

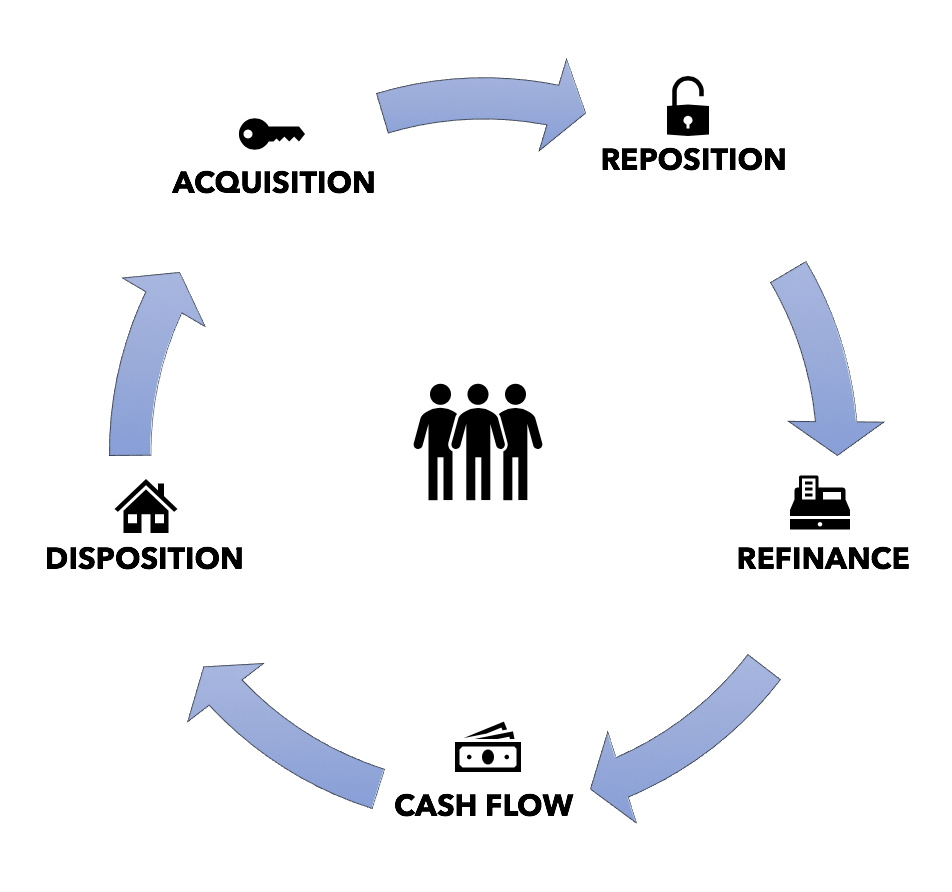

Research growth markets with strong employment and demographic trends to support a property business plan.

2 . Reposition

Reposition the property in order to attract higher quality tenants. Repositioning could involve partial demolition, extension, reorientation and change of use. This could also involve an untangling of legal restrictions that hinder a properties potential

3. Refinance

After repositioning, the property is revalued and refinanced in order to capitalise on the newly created property value.

4. Cash Flow

Our properties are built and managed for long term stable annuity income where the balance between repair and replacement, tenant incentives and credit risk are given detailed consideration

5. Disposition

Our intention is to own the assets we reposition however where opportunities to reinvest capital would deliver a better overall return for our stakeholders we will dispose properties.

Miles Stephenson - Co Founder

Miles Stephenson is a founder of Fortress Estates group of companies and the Social Savers Charity. He was the Chief Executive Officer and owner of Garigal Asset Management GmbH and is an experienced real estate executive. Miles founded Garigal with Cheyne Capital Limited in 2006 after winning industrial deal of the year in 2004. Garigal primarily invested external capital into the German real estate market and after the financial crisis was chosen by a number of banks and private equity houses including Commerz Bank, Starwood and Oaktree Capital Management to manage, reposition and sell distressed property. Garigal which employed 50 people and at the time was 30% owned by what is now the publicly listed Ares Capital Management Corporation and 20% by Capital & Regional PLC was involved in €1bn of transactions and managed over 8,000,000 sqft of retail, logistic and residential property. Garigal through its mandates completed over 1,000,000 sqft of retail development with new retail parks and shopping centre investments.

In 2014 Miles Stephenson made the personal decision to recommend to its stakeholders to exit retail property investment and to relocate his family back to the United Kingdom. The mandates have been sold or relinquished including the German State Pension Fund mandate Versorgungsanstalt des Bundes und der Länder (VBL) and Miles Stephenson has returned to the UK to invest more time in expanding and developing Fortress.

Previously Miles was at Macquarie Bank where he managed and underwrote investments in the UK, Germany and Spain.

He holds a Degree in Civil Engineering from Sydney University, a Masters in Business Administration from Manchester University and a Graduate Diploma in Finance and Investment from the Securities Institute of Australia.

Miles.stephenson@fortressestates.co.uk

Darren Carter - Co Founder

Darren is a founder of Fortress Estates group of companies and the Social Savers Charity. Darren was the Investment Director for the Social Property Impact Fund at a leading London based asset manager, Cheyne Capital, with $6bn under management. He continues to be a senior advisor to this fund. Darren had been with Cheyne since 2006.

The $300mn Social Property Fund, the first of its kind in the UK, launched in 2014, acquires and develops property which it then leases to public and social sector organisations. Investments that Darren has secured range from the purchase of individual street properties to new build developments of over 200 units. The Fund assists a wide variety of social sector organisations ranging from Local Authorities and housing associations with affordable accommodation through to charitable organisations with properties for chaotic youth and supported living.

Prior to launching the Social Property Fund, Darren was a member of the Special Investment Group, at Cheyne Capital, which oversaw the management of the firm’s real estate investments. Prior to joining Cheyne, Darren worked as a business manager for the Financial Structuring Team within the Global Banking & Markets division of The Royal Bank of Scotland in London.

Since leaving university Darren has been growing his personal real estate portfolio of single lets and completed a number of refurbishment projects and commercial to residential conversions.

Darren is actively involved in property investment meetings and has sourced distressed real estate for end buyers and investment companies. He has a 1st class BEng (Hons) from De Montfort University

darren.carter@fortressestates.co.uk